The BBC’s investigative unit, BBC Eye, has uncovered a global web of investment scammers. They have collectively robbed ordinary retail investors of over a billion dollars. The network, known to police as the Milton group, has been exposed by the BBC, which has identified the crooks behind it. Interestingly, the group had originally used the name “Milton” to describe themselves, but abandoned it in 2020. The BBC has identified a total of 152 companies within the network.

They target investors and scam them out of thousands – or in some cases hundreds of thousands – of pounds. One of these so-called companies even sponsored a top-tier football club in Spain, giving them an air of credibility. As with most scams of this nature, the majority of victims sign up after seeing an ad on social media. Within 48 hours, a phone call is received by the victim, promising returns of up to 90% per day.

We must emphasise that this is unheard of and extremely unlikely to happen in any investment opportunity. I would go so far to say that this was a lazy tactic by the scammers as it is that ridiculous. Sadly though, a lot of un-savvy investors are not to know this- especially older age groups who have not grown up with the internet.

The Perfect Victims

Taking advantage of this fact, scammers would use investors financial and social circumstances against them. Those who revealed the large scale of their savings were pressured even further to invest. On the other end of the spectrum are those who are perhaps lonely. They were more vulnerable to being emotionally manipulated, another fact that was taken advantage of.

The BBC revealed that a recent retiree, named Jane, was a perfect target. She had just taken voluntary redundancy and had a lump sum of nearly £20,000. If invested wisely, she thought could supplement her pension in the years to come. In June 2020, during the first lockdown, she saw an ad online for a company called EverFX. At that time, EverFX was one of the main sponsors of Spanish football team Sevilla FC. The club’s stars had advertised the trading platform on social media. Moreover, Jane checked it was regulated by the UK’s Financial Conduct Authority. Jane sent EverFX a message through their website and was called back and connected to someone she was told was a senior trader. Over the next few months, she invested about £15,000. But her trades weren’t doing well. She was then advised her to withdraw her money and invest with a different trading platform, BproFX. She was told she could get better returns there.

The catch here is that BproFX was not regulated, which would strip Jane of even the most basic protections. The trader had clearly gained Jane’s trust because had she done her due diligence, like she did with EverFX, she could have avoided her eventual financial loss.

The Web of Perpetrators

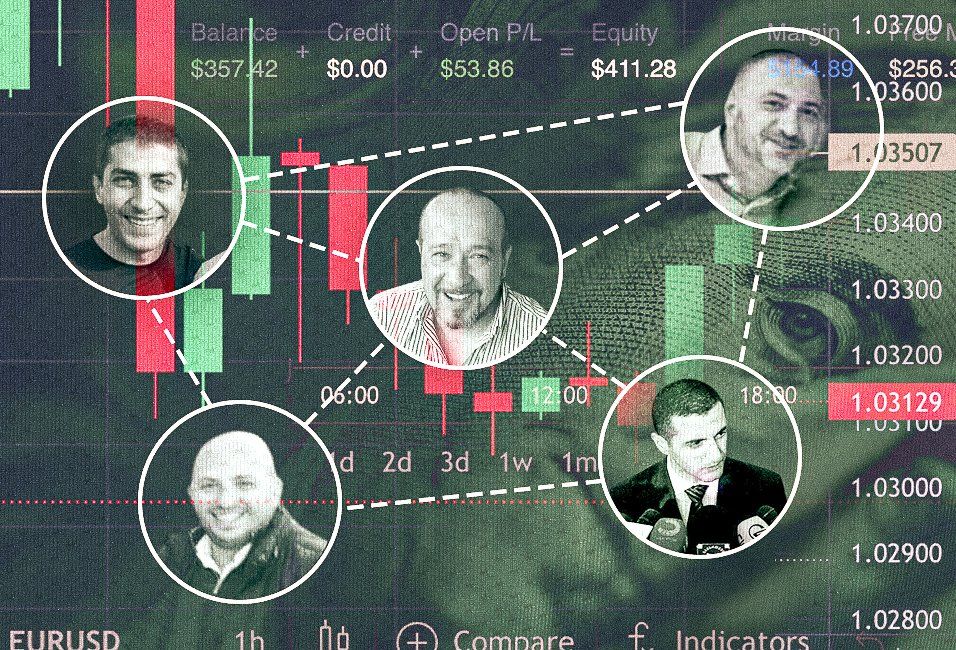

The BBC reported that they began their hunt by combing through publicly available corporate documents to find the connections between companies in the Milton group. Five names appeared again and again, listed as directors of the Milton trading platforms or supporting tech companies. David Todua, Rati Tchelidze, Guram Gogeshvili, Joseph Mgeladze, and Michael Benimini. After extensive research into parent companies and associated companies pre the Milton group, at the center of the web appeared to be one man. It all led back in some way to one figure: David Kezerashvili, a former Georgian government official who served for two years as the country’s defence minister. He has, of course, denied any association with scam companies.

Jane went down various routes, at home and abroad, in pursuit of her lost retirement funds, but got nowhere. The UK’s City of London Police took a report from her but “nothing came of it”, she said. Her bank was not able to help either, “apart from writing a few letters”.

Fraud accounted for more than £4bn worth of crime in the UK last year, and online investment scams are thought to be worth hundreds of millions of pounds per year. There are ways you can avoid being a victim of one of them by reading about due diligence here. However, if you are the victim of an investment scam and need assistance in recovering your funds- Call Us Now on 020 7504 1300.

Scam Alert

This message serves as a warning against potential online scams, including website scams and investment scams. Please exercise caution and conduct thorough research before engaging in any online transactions or investments. Protect your personal and financial information from fraudulent activities, and consult with trusted sources for advice.

Insolvency and Law Peter Murray is an award-winning consultancy firm specialising in Insolvency, debt purchasing and business rescue.